CREDITO

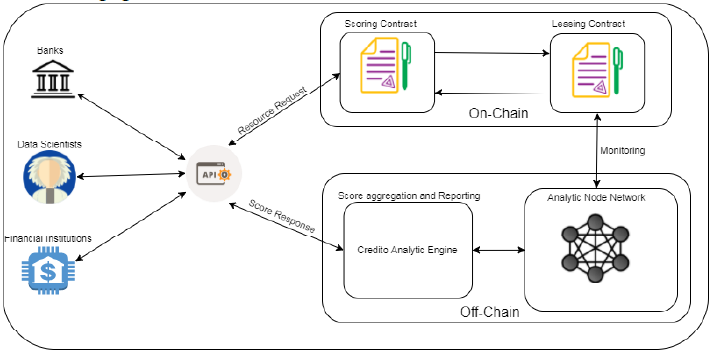

They are using smart contracts on Ethereum network with ERC 20 compatible tokens. Tokens which are made for purpose of these project. Founders of Credito wanted to achieve that everyone could trace transactions. With this new platform, which is decentralized we will be able to track transactions, credit scores and many more. The market is suffering huge losses of hundreds of billions of dollars a year because of the exploitation of others work. https://credito.io/There are many frauds and they are hard to trace. They have found a solution for this.

Credito brings Financial Inclusion to the “Credit Invisibles” by providing accurate and reliable credit scores.

According to a 2016 report by Nilson, losses from credit card fraud amounted to $21.8 billion in 2015 that’s an increase of 162% from the 2010 figure which was $8 billion. The losses for 2016 are already estimated at over $24 billion, and these losses are expected to reach $31 billion by 2020.

The total value of credit and debit card transactions was $31 trillion in 2015.

According to a 2016 report by Nilson, losses from credit card fraud amounted to $21.8 billion in 2015 that’s an increase of 162% from the 2010 figure which was $8 billion. The losses for 2016 are already estimated at over $24 billion, and these losses are expected to reach $31 billion by 2020.

The total value of credit and debit card transactions was $31 trillion in 2015.

Credito Loan Agreements are self-executing contracts with the terms of the agreement between Lender and Borrower, directly written into lines of code which brings enhanced transparency and reliability. The code and the agreements contained therein exist across a distributed, decentralized blockchain network. Credito Loan Agreements permit trusted transactions and agreements to be carried out among disparate, anonymous parties without the need for a central authority, legal system, or external enforcement mechanism. They render transactions traceable, transparent, and irreversible

Credito is “Trustless”

Credito will avoid risks that are associated with third parties, and also removes the need to trust the counterparty. When the borrower places the loan request on Credito Network, the counterparty cannot manipulate or halt the loan request once the loan is deployed. Removing the counterparty or third party risk is vital to avoid any unfair and unwanted behaviour.

\Challenges:

- Monopoly

- Security

- Centralized Information

- Portability

- Outdated Analytics and Incomplete information

Solution

i. Transparent

ii. Loan Agreements are Smart Contracts

iii. Trustless

i. Transparent

ii. Loan Agreements are Smart Contracts

iii. Trustless

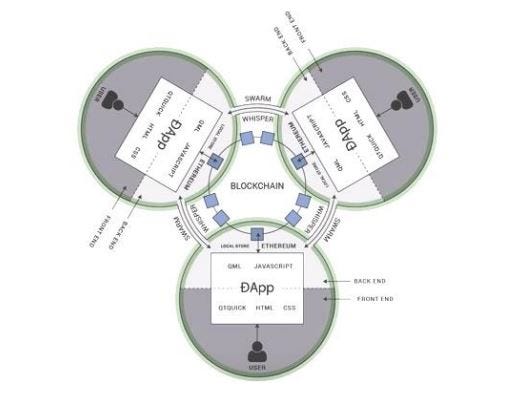

As a solution to the above problems, we have created the Credito Network, or simply Credito. A decentralized network based on Ethereum blockchain coupled with smart contracts and Interplanetary File System (IPFS5) providing Credit Intelligence and Decentralized Lending Marketplace.

Credito encourages the expanding and proficient operation of the credit industry by permitting both fiat and digital resource loan specialists to broaden credit to people and establishments with underdeveloped or a juvenile credit framework. The ecosystem provides solutions to enable any verified lender to safely and securely issue credit to the verified borrower.

Decentralization provides more security and trust. It is a method to organise anything in a way that does not require trust on third parties. The trust is eliminated by executing code that does not require centralized governance, management, or servers. By decentralizing lending, we do not require banks or any other intermediaries for conducting a loan transaction.

Credito encourages the expanding and proficient operation of the credit industry by permitting both fiat and digital resource loan specialists to broaden credit to people and establishments with underdeveloped or a juvenile credit framework. The ecosystem provides solutions to enable any verified lender to safely and securely issue credit to the verified borrower.

Decentralization provides more security and trust. It is a method to organise anything in a way that does not require trust on third parties. The trust is eliminated by executing code that does not require centralized governance, management, or servers. By decentralizing lending, we do not require banks or any other intermediaries for conducting a loan transaction.

Website: https://credito.io/

Whitepaper: https://credito.io/pdf/whitepaper.pdf

Announcement: https://bitcointalk.org/index.php?topic=2483679.0

Facebook: https://www.facebook.com/CreditoNetwork

Twitter: https://twitter.com/CreditoNetwork

LinkedIn: https://www.linkedin.com/company/credito-network

Whitepaper: https://credito.io/pdf/whitepaper.pdf

Announcement: https://bitcointalk.org/index.php?topic=2483679.0

Facebook: https://www.facebook.com/CreditoNetwork

Twitter: https://twitter.com/CreditoNetwork

LinkedIn: https://www.linkedin.com/company/credito-network

Комментариев нет:

Отправить комментарий